The Objective: Automated KYC Application Processing

The Client, a fintech company, is responsible for the issuance of Know Your Client (KYC) acknowledgment to its other customers. All its customers share their applicant’s KYC details including Application forms, Identity & Address Proof documents. The client is required to match the data with its own information, verify the details and provide a KYC acknowledgment letter. The Client used to perform this process manually and wanted to automate this KYC application process.

Challenges: Meeting SLA’s commitment & Unable to scale manual operations

Due to the rapid increase in KYC requests in recent years, the client faced challenges in meeting SLA’s commitment to their customers as they were not able to scale manual operations easily. There was also a possibility of error in the manual handling of backend information, manual extraction and matching of the submissions. It was difficult for them to handle different types of applications from a single distribution point.

In addition, the current production system has more than 150 Data Providers with different KYC applications and Supporting Document formats, and these formats are getting continuously updated. This required the solution to have the capability to accommodate these changes.

The Solution: Building Machine Learning Model

Datametica automated end to end verification of various KYC applications by building deep learning and AI/ML models. The Solution developed was able to perform data extraction from any digital KYC application with minimal effort. It handled more than one type of KYC forms format from a single CVL client.

We also designed a front end UI with Labeling capabilities to enable end-users to tag KYC forms, and train / retrain Deep Learning object detection models to provide support for new supporting documents or new formats of existing supporting documents. Further details of the projects are as below:

- First, partnered with the client to understand the overall process automation requirement and facilitate the setting up of a framework or solution to ensure automation

- Developed an image processing / deep learning & machine learning-based model and custom computer vision OCR (Optical Character Recognition) codebase to extract applicant information from printed application forms and KYC documents

- Post extraction of essential information from the application form and KYC document, the data/files processing pipeline also performed comparison exercises between the Application form vs KYC document vs information from the client’s database

- The data comparison & integration pipeline also generated match scores with the necessary flags and took care of automatic file movement, copy, splitting, masking and compression.

- Designed and Developed a front end UI with Labeling capabilities to upload KYC documents, tag KYC supporting documents and trigger a model training pipeline.

- Develop Image Processing Pipeline to retrain the tagged supporting documents

- Performed Deep Machine Learning Models optimization

- Identify new data points in KYC form by creating the logic to Validate & Classify additional tags and perform verification with the client’s Metadata.

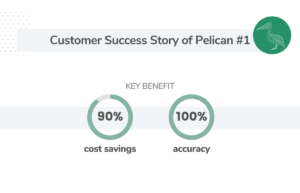

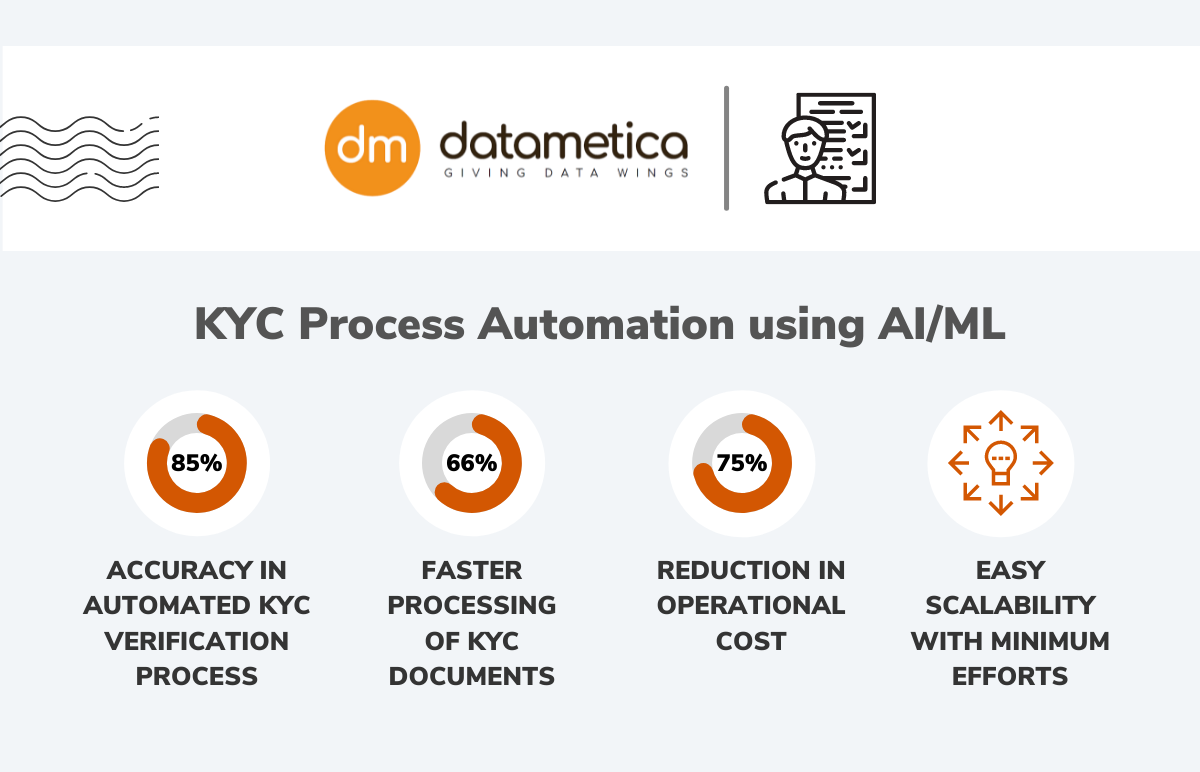

Benefits: 75% reduction in KYC processing cost with 66% faster processing.

- Achieved 85% Accuracy in automated KYC verification process.

- 66% faster Processing of KYC documents.

- Upto 75% reduction in operational cost with –

- Reduced manual intervention

- AI/ML Models

- Automated Files Classification

- Easy scalability with minimum efforts.

Recommended for you

subscribe to our case study

let your data move seamlessly to cloud